This year marks the 12th edition of Accenture’s FinTech Innovation Lab London – a world-renowned, 12-week programme that is all about helping early stage FinTechs accelerate their product-market fit and business development.

We can’t wait to take our cohort through our carefully designed in-depth innovation, partnership and scaling programme, coupled with engagements with over 35 Accenture clients, and a panel of industry leading mentors.

2024’s cohort saw our most testing selection process yet, with total applicant numbers reaching over 300, and a final cohort acceptance rate of 4.6%! Our interviewees represented a global FinTech world, with applicants from 15 different countries around the world, and over 50% with founders from diverse backgrounds. Each of these FinTechs were scored an average of 22 times by our experienced partners and mentors to give us the data required to select one of our strongest cohorts to date, aligned to our partner’s priority areas.

We are confident that the solutions these FinTechs bring to the table will actively shape the market and redefine financial experiences in the years ahead. We are honoured to be able to attract so many talented, motivated and brave founders into our programme.

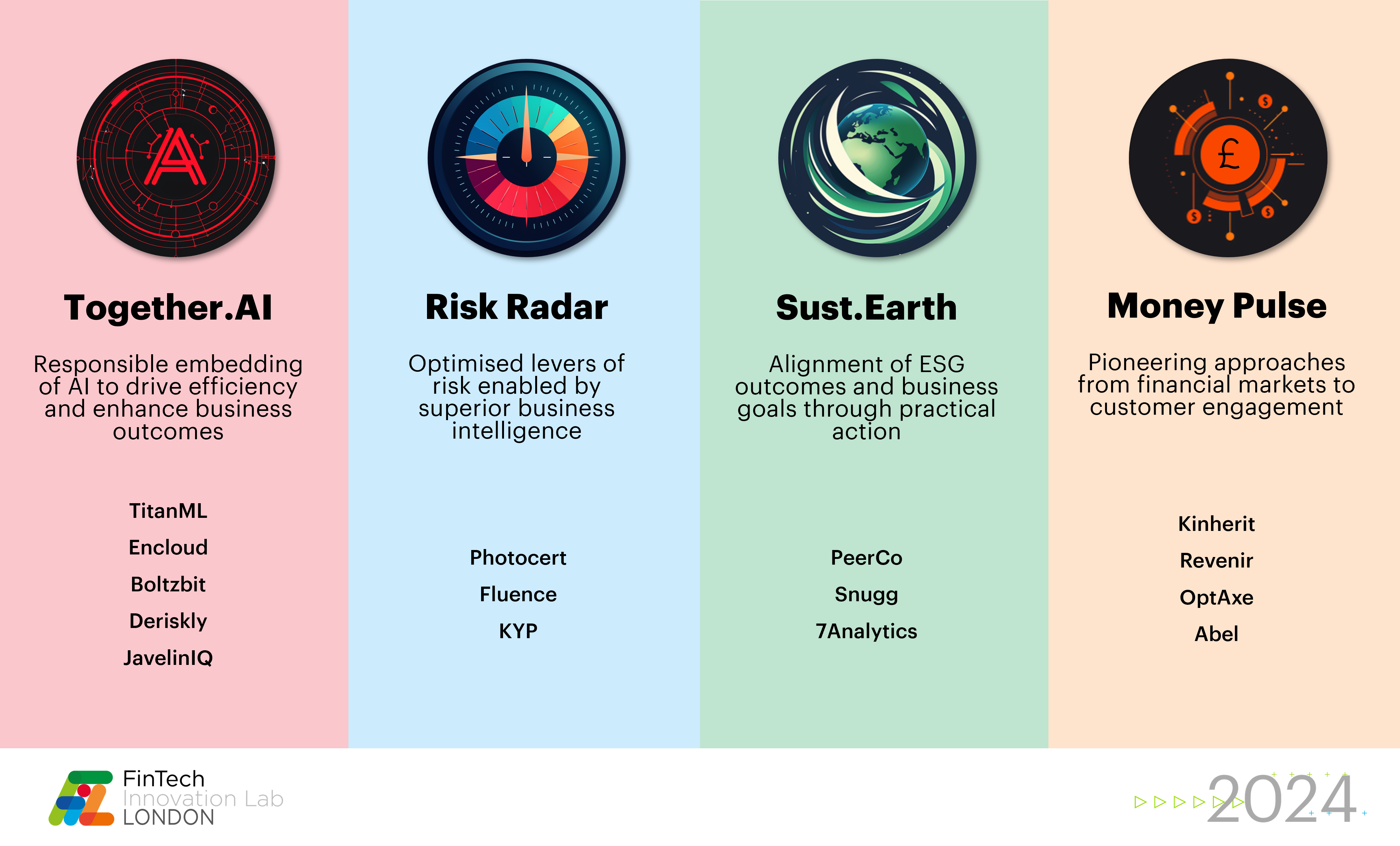

With our 4 streams representing where we see the world today, we can’t wait to get started.

Businesses are constantly being told to grapple with artificial intelligence technology, but how do they do that? Our Together.AI stream is set to help companies drive efficiencies and enhance outcomes.

As we are tasked with dealing with more threats and uncertainties from seemingly endless sources, our Risk Radar stream exists to power businesses with superior intelligence so that they can continually act with confidence, at pace.

Sust.Earth is our answer to a misaligned ESG and business goals landscape. These companies use innovative technologies to make short term planet saving changes actionable and investible. Imagine the impact they are going to have at scale.

In a world of increased migration and transfer of value amidst a cost-of-living crisis, we need companies that make finance easy for us. Our Money Pulse stream is there to create a smooth flow of finances between organisations, countries and people.

Check out our 2024 streams and meet the FinTechs ready to change the financial landscape.

Introducing our FinTech Cohort of 2024!

Together.AI – Responsible embedding of AI to drive efficiency and enhance business outcomes.

- Deriskly: offers advanced AI software for regulated firms to optimise compliance of their financial promotions and communications

- JavelinIQ: accelerates and automated research and analysis for leading M&A professionals and investors

- Boltzbit: provides private generative AI models, that learn the preferred workflow of clients with each iteration. Analysts can scan thousands of documents in minutes

- TitanML: generative AI solution which takes care of core infrastructural problems associated with building self-hosted LLM applications

- encloud: building the world’s first interoperable, and secure SaaS platform that makes privacy-assured generative AI simple and high-quality

Risk Radar – Optimised levers of risk enabled by superior business intelligence.

- Photocert: authenticates digital media, from photos to documents, using state-of-the-art technology to optimise processes that rely on such data

- Fluence: helps users incorporate unidentified risks that exist primarily in unstructured reports, such as prior claims, engineering reports etc.

- KYP: offers ongoing KYB monitoring, providing alerts on 3rd parties. Approach involves analysis of DarkWeb, Adverse Media, PEPs, Sanctions, Cyber Risk etc.

Sust.Earth –Alignment of ESG outcomes and business goals through practical action.

- Snugg: helps home-owners identity and fund the improvements they need. It draws on multiple data sets to help educate users on their homes’ energy efficiency

- PeerCo: uses electricity data to verify carbon savings. Customers can bank their saved carbon, use it as a carbon ‘inset’ or sell it as a carbon credit

- 7Analytics: understand nature. Adapt to climate change. Improve insurance pricing using high precision flood risk data.

Money Pulse – Pioneering approaches from financial markets to customer engagement.

- kinherit: a Wills & Trusts specialist that has developed a FinTech platform to sit at the heart of US $7 trillion of wealth that is transferred every year on death.

- revenir: developed an API services which allows tourists return from Europe to automatically claim back VAT on their shopping abroad.

- Abel: helps SME lenders to quickly quote and acquire profitable customers across multiple channels from a single API.

- OptAxe: an FX option platform, built for institutional traders to connect, distribute, and consume FX liquidity on a centralised venue.