It was time for Interview Day #8 to check out the FinTechs who are paving the way to comfort in an increasingly risky world.

Changing regulations, a diminishing trust in the health service, and savvy customers are changing the landscape faster than ever before.

Our 8th Stream spotlight is focused on Insurance, and the innovative FinTechs using the latest technology to keep us feeling safe and secure.

InsurTech: Where Innovation Meets Resiliance

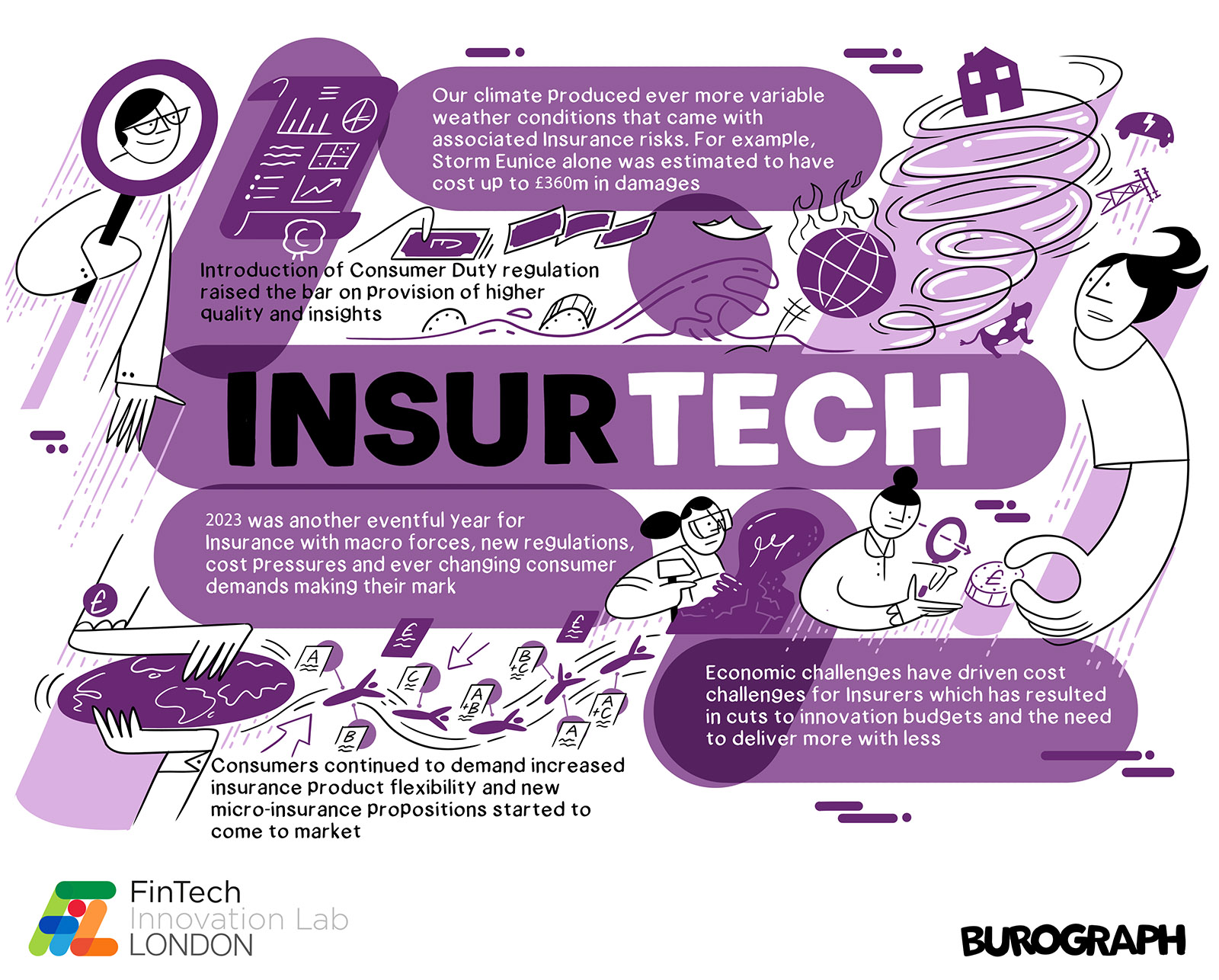

2023 was yet another eventful year for the Insurance industry with macro forces, new regulation, cost pressures and ever changing consumer demands all making their mark. To name a few key highlights:

- The introduction of the Consumer Duty regulation consequently raised the bar on the provision of higher quality data and insights; always a challenge for an industry littered with legacy systems. Data quality will be further stretched in 2024 as closed books come into scope of the regulation.

- Climate continued to dominate Insurer’s focus with 2023 being the hottest year on record triggering ever more variable weather conditions and associated risks out-with the control of Insurers. Storm Eunice alone was estimated to have cost up to £360m in damages.

- From a consumer perspective, the demand pressure for increased product flexibility continued with the consequences of Consumer Duty fuelling this further. Across the market we observed a flurry of new micro-insurance propositions whilst Insurance providers continued to invest in modern, core technology engines to build more flexibility and agility.

- Sustainability continued to increase its influence with the volume of Sustainability Reporting in pipeline continuing alongside ESG considerations continuing to be an important consumer consideration, balanced with the need for affordability.

- Finally, driven by recent economic challenges, the pressure of cost challenges prevails within Insurance organisations resulting in eroded Change budgets and the need to deliver more change with less funding.

The need for InsurTech innovation to support Insurers to solve these many business critical challenges has never been so crucial.

Consequently, the need for InsurTech innovation to support Insurers to solve these many business critical challenges has never been so crucial. Looking to the candidates within both the InsurTech stream, and across the wider FinTech pool, 3 core categories of FinTech emerge that all resonate strongly in supporting Insurers face into their priority challenges whilst also enhancing their differentiation. Firstly, there have been an influx of applicants that seek to transform core insurance journeys, driving down cost and building superior user experience. Secondly, there are a breath of applicants who seek to revolutionise organisation capabilities through more effective use of data and enhanced agility. Finally, there are a number of interesting applicants who look to differentiate the Insurance proposition leveraging state of the art technology.

We are delighted to meet the 2024 FIL cohort and commence the co-creation journey to innovate collectively to solve Insurers most significant business challenges.

Through bringing together a blend of FinTechs, Partners, our breadth of affiliates and industry experts from within Accenture, we believe this will stimulate the magic formula for success.

We are delighted to welcome you to the Lab and are very excited to kick off our 2024 journey together.

Chloe Harmer, Managing Director and Insurance SME

Keep an eye out for some exciting InsurTech offerings as we reveal our FinTech cohort for 2024!