It was time for Interview Day #6 to check out the power of Open Finance.

Working at the frontier of financial innovation, Open Finance reimagines traditional banking by fostering transparency, accessibility, and interconnectedness in the financial ecosystem.

Our 6th Stream spotlight will introduce many ways in which FinTechs are making the most of data in an Open Finance world.

Open Finance: Streamlining Intricate Economic Lives

The aftermath of the Covid-19 pandemic has ignited an unprecedented demand for innovative financial solutions. Beyond the surge in contactless transactions and seamless online payments, the financial services landscape is evolving with a mission to transcend outdated processes and usher in a realm of new opportunities.

It is more than just a progression from Open Banking; it’s a holistic expansion into a universe of financial products and services.

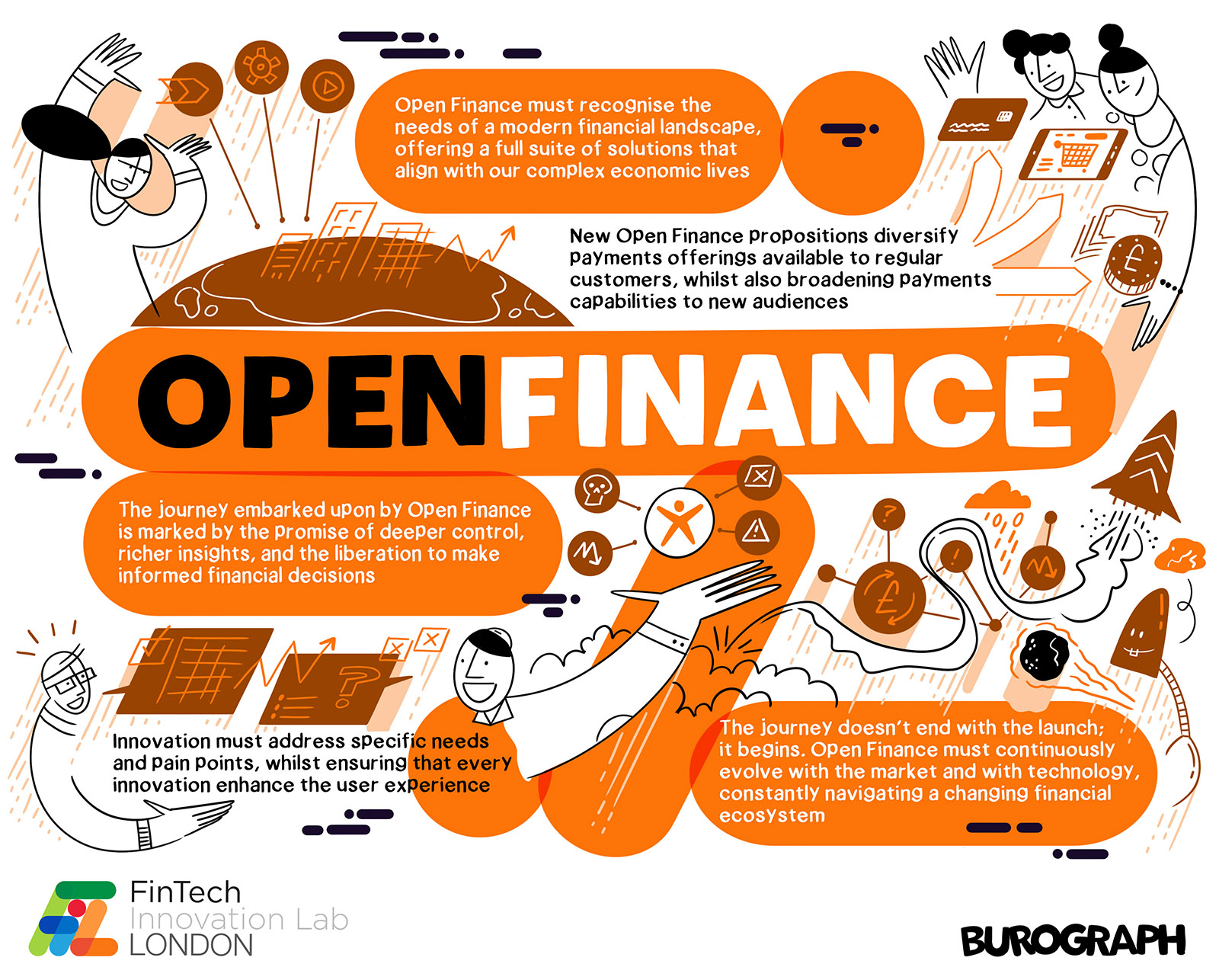

Though Open Banking has been around since 2018, the JROC Report which released in April 2023 has catapulted Open Finance into the British Payments landscape. It is more than just a progression from Open Banking; it’s a holistic expansion into a universe of financial products and services. Beyond payments, it encompasses savings, investments, insurances, mortgages, and pensions, empowering individuals and businesses alike. The journey embarked upon by Open Finance is marked by the promise of deeper control, richer insights, and the liberation to make informed financial decisions.

Open Finance is a journey that recognises the dynamic needs of a modern financial landscape,

Though Open Banking has been around since 2018, the JROC Report which released in April 2023 has catapulted Open Finance into the British Payments landscape. It is more than just a progression from Open Banking; it’s a holistic expansion into a universe of financial products and services. Beyond payments, it encompasses savings, investments, insurances, mortgages, and pensions, empowering individuals and businesses alike. The journey embarked upon by Open Finance is marked by the promise of deeper control, richer insights, and the liberation to make informed financial decisions.

Not only does Open Finance streamline payments journeys, but it also paves the way for a myriad of Embedded Finance opportunities which amplify the transformative impact initiated by Open Banking. These propositions enrich and diversify existing payments offerings available to regular customers, whilst also broadening payments capabilities to a whole host of new audiences. Open Finance is a journey that recognises the dynamic needs of a modern financial landscape, offering a comprehensive suite of solutions that align with the intricacies of our economic lives.

For such solutions to thrive in the UK, a strategic approach is imperative. Here are key considerations:

- Customer-Centric Innovation: Tailor solutions to address specific needs and pain points, ensuring that every innovation enhances the user experience.

- Clear Value Propositions: Communicate the ‘why’ behind your Open Finance initiatives transparently, allowing stakeholders to understand the value proposition and integration into existing business strategies.

- Adaptive Evolution: The journey doesn’t end with the launch; it begins. Continuously evolve with market dynamics and identify new user cases that can be embraced to drive wider adoption.

- Navigate the Financial Ecosystem: A profound understanding of the complexities within the financial services sector is crucial. This knowledge will inform decisions when building, buying, or entering strategic partnerships.

- Strategic Partnerships: Forge long-term collaborations that strike a balance between adaptability and a commitment to contribute to the current financial landscape for the sake of innovation.

As we stand on the precipice of this financial revolution, Open Finance guarantees more than just change; it promises an expansive landscape of possibilities built on preparation, education, and a commitment.

Sulabh Agarwal, Payments Global Lead, Accenture

Ewa Wojcik, Payments Senior Manager, Accenture

Keep an eye out for some exciting Open Finance offerings as we reveal our FinTech cohort for 2024!